Vitality costs surged Monday as fears grew of a cutoff of Russian provides as a consequence of the invasion of Ukraine ordered by President Vladimir V. Putin.

Oil costs briefly spiked as excessive as $138 a barrel earlier than settling again to about $127 a barrel, the very best since 2008. European pure fuel costs are much more elevated, with futures on the Dutch TTF change hitting 345 euros per megawatt-hour — comparable to grease reaching above $500 a barrel.

Some analysts now say that Russia’s transfer into Ukraine is prone to have long-lasting implications for commodities markets as a result of Russia is central not solely to the power business but additionally to a variety of agricultural merchandise and minerals. Futures for objects like wheat, palladium and aluminum have been hovering.

As well as, as analysts at Citigroup wrote not too long ago, this geopolitical turmoil is happening at a time when many countries have dedicated to “undo” power habits involving fossil fuels established over greater than a century inside 30 years with a purpose to deal with local weather change.

The rupture in markets Monday prolonged once more to shares. Share costs in Asia fell sharply and Europe’s most important indexes have been decrease, with the DAX in Germany down 3 % and the Stoxx Europe 600 dropping 2.2 %. On Wall Road, the S&P 500 was anticipated to fall 1.6 % when buying and selling begins.

The most recent spike in power costs seems to have been stoked by an rising effort to embargo Russian power exports as punishment for the nation’s struggle towards Ukraine. There have been calls from lawmakers in Washington to dam imports of Russian oil, and Secretary of State Antony J. Blinken has added to expectations that some form of embargo is within the works throughout his latest tour of nations close to Ukraine.

“We are actually in very lively discussions with our European companions about banning the import of Russian oil to our international locations whereas, after all, on the identical time sustaining a gentle international provide of oil,” Mr. Blinken stated Sunday on “Meet the Press” on NBC.

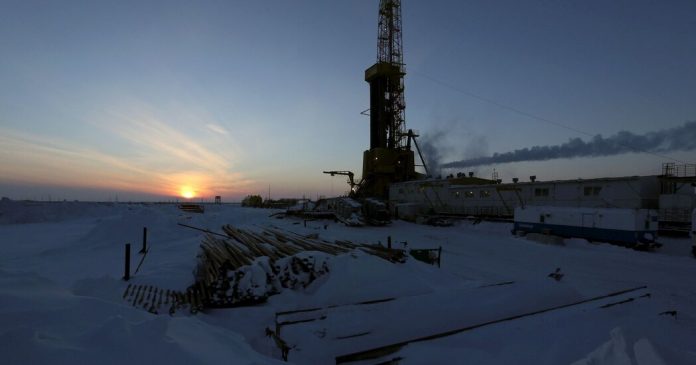

A precipitous drop in oil and pure fuel provides from Russia would create main issues for each industrial customers and customers. Russia is likely one of the world’s main oil producers, accounting for one in 10 barrels produced globally, and about 60 % of the nation’s oil exports go to Europe, in response to the Worldwide Vitality Company.

Reducing off Russian oil would power many refineries that usually course of it to search out different sources. Whereas oil is a comparatively versatile commodity, there are various totally different grades of crude, and a refiner can’t at all times substitute one for one more. Washington’s sanctions on Venezuelan crude, as an illustration, have led refiners in america to purchase extra Russian oil in its place, elevating import ranges.

On Saturday, Shell, Europe’s largest oil firm, stated that it had purchased a cargo of Russian crude oil as a result of provides from “different sources wouldn’t have arrived in time to keep away from disruptions to market provide” Gasoline costs are already excessive, with the value of a gallon in america rising above $4, approaching a file set in 2008. The typical worth in California was $5.34 on Monday, up 51 cents prior to now week, in response to information from AAA, the motor membership.

Pure fuel is much less versatile than oil, and Europe is rather more depending on it as a gas, with Russia accounting for round one-third of provides in regular instances. Present costs don’t appear sustainable, analysts stated.

“It’s so costly that you’re going to drive utilities into steep losses,” stated Henning Gloystein, a director on the Eurasia Group, a political danger agency.