2 / 16

1982: Dimon graduates from Harvard Enterprise College

1982: Dimon graduates from Harvard Enterprise College

3 / 16

1986: Dimon goes with Weill to Industrial Credit score

1986: Dimon goes with Weill to Industrial Credit score

4 / 16

1998: Vacationers merges with Citicorp

1998: Vacationers merges with Citicorp

Dimon turns into president of the merged firm, now often known as Citigroup, whereas Weill and Citi’s John Reed briefly function co-CEOs. However Dimon’s relationship with Weill sours and throughout the yr he’s compelled out by his longtime mentor.

5 / 16

2000: Financial institution One hires Dimon as CEO

2000: Financial institution One hires Dimon as CEO

After a short hiatus, Dimon resurfaces in Chicago, the place Financial institution One, one other product of business consolidation, is in determined want of recent management to tame the corporate’s infighting.

6 / 16

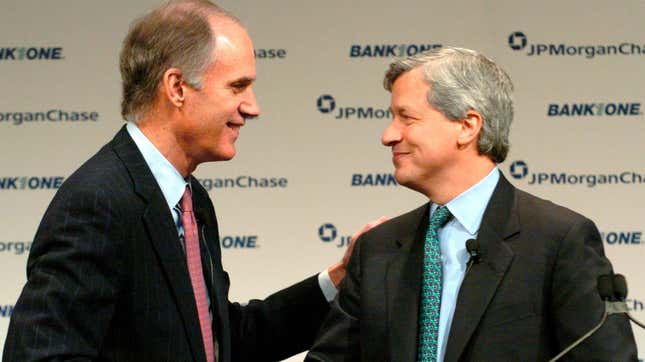

2004: Financial institution One enters a merger with JPMorgan Chase

2004: Financial institution One enters a merger with JPMorgan Chase

After a two-year transition plan mapped out as a part of the Financial institution One-JPMorgan Chase merger, Dimon takes over from JPMorgan’s William Harrison Jr. as CEO of the mixed firm on Dec. 31, 2005.

7 / 16

2008: JPMorgan acquires Bear Stearns and Washington Mutual

2008: JPMorgan acquires Bear Stearns and Washington Mutual

The offers are struck throughout acute phases of the worldwide monetary disaster. They solidify Dimon’s fame because the financial institution business’s elder statesman and as a associate to the US authorities in disaster conditions. However additionally they drain JPMorgan Chase’s coffers of billions of {dollars} in authorized prices tied to dodgy loans on the books at Bear Stearns and WaMu. Dimon would later say he regrets buying Bear Stearns because it imploded and will have paid far much less for the failed WaMu.

8 / 16

2009: Dimon is within the combine as a attainable decide for US Treasury secretary

2009: Dimon is within the combine as a attainable decide for US Treasury secretary

Regardless of the rumors, there isn’t a nomination forthcoming from the Obama administration because the Occupy Wall Avenue motion makes a splash and anti-bank rhetoric heats up.

9 / 16

2012: A scandal in London provides Dimon a proverbial black eye

2012: A scandal in London provides Dimon a proverbial black eye

10 / 16

2014: Dimon goes public together with his most cancers analysis

2014: Dimon goes public together with his most cancers analysis

A bout of throat most cancers curtails the globetrotting government’s journey schedule as he undergoes therapy close to his residence in New York. The therapy is profitable.

11 / 16

2016: Dimon is once more talked about as a attainable decide for US Treasury secretary

2016: Dimon is once more talked about as a attainable decide for US Treasury secretary

Dimon reportedly turns down incoming US president Donald Trump’s provide of a nomination. The put up as an alternative goes to Steve Mnuchin.

12 / 16

2020: Is the third time a allure?

2020: Is the third time a allure?

13 / 16

2021: Dimon locks in as CEO for 5 extra years

2021: Dimon locks in as CEO for 5 extra years

14 / 16

2022: Dimon sharpens his long-running assaults on crypto

2022: Dimon sharpens his long-running assaults on crypto

He tells CNBC that crypto is a sideshow and likens crypto tokens to “pet rocks.”

15 / 16

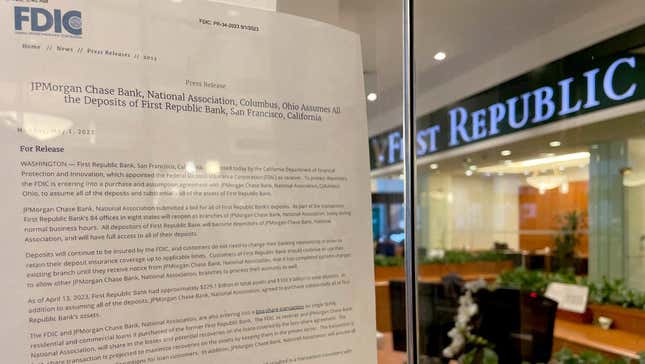

2023: Dimon takes the lead on First Republic

2023: Dimon takes the lead on First Republic

As First Republic Financial institution will get caught up in a gathering banking panic, Dimon works with US Treasury secretary Janet Yellen to safe an infusion of billions of {dollars} in deposits from 11 large US banks. When the rescue plan fails and First Republic teeters into receivership, JPMorgan Chase emerges with the profitable bid for considerably all of First Republic’s property and deposits—and says it is going to return the deposits put up by the opposite large banks that tried to assist stabilize First Republic.