Floridians might have a pathway to college savings through the state’s Prepaid College Savings Plans, but they have only about a month before the open enrollment window closes.

As parents look for ways to reduce their child’s future student debt, the prepaid plans allow them to get ahead of the surging costs of higher education.

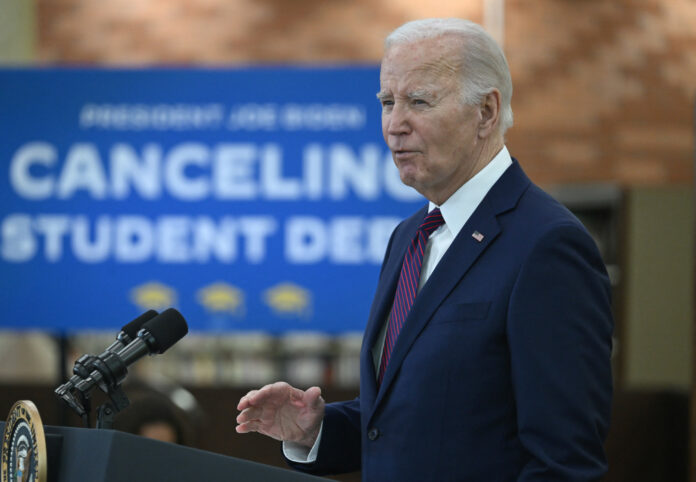

President Joe Biden has passed several plans to lower student debt payments or erase loans for Americans if they meet certain criteria. But for the majority of Americans, student loan debt can still weigh on them, creating difficulties when they look to buy a house, start a family or even plan for retirement.

Under the Florida Prepaid College Savings plan, parents can contribute as low as $34 a month for their child to have lower college costs in the future. But the deadline is approaching to sign up this year, and residents have just over a month to commit to the program as open enrollment ends April 30.

ANDREW CABALLERO-REYNOLDS/AFP via Getty Images

Across all five of the prepaid plans, that means families will get 25 percent off in cost reductions.

“Plans like Florida’s for college allow parents to essentially lock in current tuition prices and prepay them, while also covering the difference if tuition prices increase,” Alex Beene, a financial literacy instructor for the state of Tennessee, told Newsweek. “Clearly with the soaring costs of a college degree in recent years, plans like these can help students and their families save a great amount of money on the front end.”

The plans launched about 35 years ago as Florida looked to make college affordable and have helped families for years even as they navigate high inflation. Inflation was at 3.2 percent as of February, but Americans are still battling a nationwide $1.6 trillion plus in student debt.

So far under Florida’s plans, 620,000 students have been able to attend college at any of the 12 state universities, 28 state colleges or hundreds of technical and vocational programs.

“By selecting a prepaid college plan, parents can lock in tuition prices now for their children,” Michael Lux, the founder of The Student Loan Sherpa, told Newsweek. “The idea is to ensure that school is paid for up front so that their kids don’t have to worry about student debt.”

Some people, though, may be hesitant to invest in the programs early without knowing exactly which path their child will take in their career.

“I also think it’s important to first have a discussion on different pathways for students toward their professional future first,” Beene said. “Increasingly, many families are starting to realize a college degree may not be the only or best way for their student to obtain a career. Even if a plan can save you money, you need to ask if it’s needed in the first place.”

If people end up paying for the plan only to find out your child doesn’t plan to attend college, that will result in lost money in interest.

“You are betting that your child will attend college,” Lux said. “If your child doesn’t go to college, you can get back the money you put in, but you lose out on interest that money would have generated.”

Still, the option stands as an example to other states in terms of how they could curb their own residents’ out-of-pocket educational costs, said Scott Winstead, CEO and founder of MyElearningWorld.com.

“Other states could benefit from implementing similar schemes to support their residents,” Winstead told Newsweek. “However, you also have to consider potential drawbacks such as less flexibility compared to other investment options. This approach contributes to the broader dialogue on student debt, offering a preventative strategy rather than focusing solely on debt forgiveness.”

Nationwide Forgiveness

Recently, Biden has made headlines for his new student debt forgiveness options under the Department of Education. This year, that included $5 billion more in federal student loan forgiveness to those who have worked 10 years or more in public service and people repaying their loans for at least 20 years who haven’t been able to get help through income-based plans.

Altogether, 74,000 more borrowers will see relief.

Biden has faced pushback since the U.S. Supreme Court struck down his prior plan to cancel student loan debt last June. That plan would have seen forgiveness for up to $10,000 in debt for those making less than $125,000 a year.

Nationally, more than 3.7 million Americans have had their student debt cleared, which was an early promise Biden made when he took office.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.