Meta’s inventory surged on Thursday after the corporate reported better-than-expected earnings, mentioned it will purchase again billions of {dollars} in its inventory, and overcame a courtroom problem to its ambitions within the so-called metaverse.

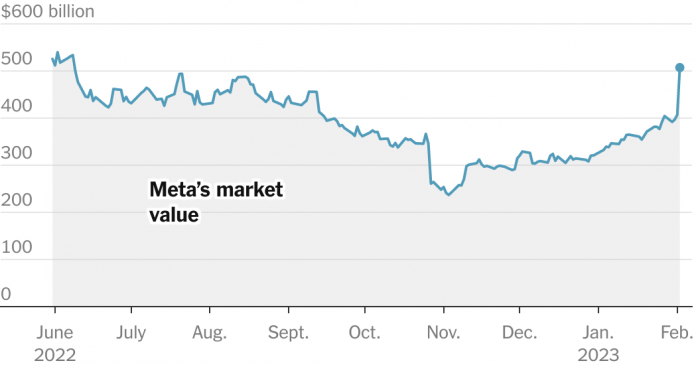

Shares of the tech large, the proprietor of Fb, Instagram and WhatsApp, climbed greater than 24 p.c, which might be its greatest day by day achieve in almost 10 years. And it’s a enormous transfer for a corporation its measurement, including some $100 billion in market worth in a single day, or about as a lot as Citigroup’s total market capitalization.

What Is the Metaverse, and Why Does It Matter?

The origins. The phrase “metaverse” describes a completely realized digital world that exists past the one during which we reside. It was coined by Neal Stephenson in his 1992 novel “Snow Crash,” and the idea was additional explored by Ernest Cline in his novel “Prepared Participant One.”

After ending final 12 months with a lack of greater than 60 p.c, Meta’s inventory is up greater than 50 p.c this 12 months, because the temper amongst tech traders has brightened. The Nasdaq Composite, an index that features many tech firms, together with Meta, has risen almost 20 p.c this 12 months.

Right here is the most recent on Meta:

-

The corporate’s earnings beat expectations, and it introduced an enormous buyback plan. Its income within the ultimate three months of final 12 months, simply over $32 billion, was down 4 p.c from a 12 months in the past however forward of analysts’ forecasts. On Wednesday, the corporate additionally mentioned that first-quarter gross sales could be higher than anticipated and introduced $40 billion in share buybacks, after shopping for $28 billion of its personal shares final 12 months.

-

Flat — and even barely down — is the brand new up. Regardless of falling income, Meta’s core merchandise like Fb and Instagram nonetheless put up robust gross sales amid a troublesome financial local weather. That buoyed Wall Avenue sentiment on the enterprise, and batted again among the extra pressing considerations that Meta is in imminent hazard from challengers like Apple, TikTok or different social media firms — for now, no less than.

-

Meta executives can reduce prices when wanted. For years, Meta spent lavishly on breakneck enlargement, be it within the type of new workplaces, ballooning head rely or future-facing expertise with no instant moneymaking plans. However in its newest quarter, the corporate proved it might discover areas to trim when pressured to take action. Mark Zuckerberg, Meta’s chief government, referred to as 2023 “the 12 months of effectivity” on an earnings name on Wednesday, together with terminating a spate of workplace leases, redesigning information facilities to value much less and shedding 1000’s of what he described have been “managers managing managers.” Wall Avenue welcomed the strikes.

-

Meta can nonetheless carry new folks to Fb. The massive blue Fb app surpassed two billion day by day energetic customers for the primary time final quarter, an infinite milestone and surprising given the service’s already massive measurement. It’s a sign that whereas competitors from different social networks is stiff, persons are nonetheless utilizing Fb.

-

Its digital actuality deal survived a authorized problem. On Wednesday, a federal decide rejected the Federal Commerce Fee’s request to dam Meta from spending $400 billion to accumulate a digital actuality start-up referred to as Inside, representing a significant authorized victory for the corporate because it invests closely within the metaverse, the place customers work, play and devour content material by digital and augmented actuality. (Much less fortunately for Meta, a month in the past European regulators dominated that it had illegally compelled customers to successfully settle for customized adverts, fining the corporate greater than $400 million and probably forcing it to make pricey adjustments to its advert enterprise within the European Union.)

-

Loads of challenges stay. Meta faces setbacks in digital promoting as purchasers rein in spending due to larger rates of interest and inflation. The corporate can be preventing to retain customers drawn to newer apps like TikTok, the short-form video app that Mr. Zuckerberg considers one in every of his most formidable rivals. The billions that Meta is spending pursuing its founder’s imaginative and prescient of the metaverse might not repay.

-

Meta laid off greater than 11,000 staff in November. The corporate lowered its work drive by 13 p.c within the spherical of layoffs, in what amounted to probably the most important job cuts since its founding in 2004. Meta took a $4.2 billion restructuring cost for the fourth quarter, together with prices for the early termination of workplace leases and severance for workers. The corporate expects one other $1 billion in restructuring prices in 2023.