This week has dealt a blow to Trump Media & Technology Group Corp, with the stock seeing a 25 percent decline coupled with the cost to short sell dropping markedly.

The dual hit suggests an increasingly cautious approach from investors towards the company represented by the former President’s initials, DJT, which has plummeted over 38 percent since completing its merger with blank-check company Digital World Acquisition Corp in late March.

Amid the market tumult, DJT, one of the poorest performers on the stock market this week, faced another setback as borrowing fees for short selling the stock slid from a high of 790 percent last week to 124 percent on Friday, according to data from brokerage firm Interactive Brokers.

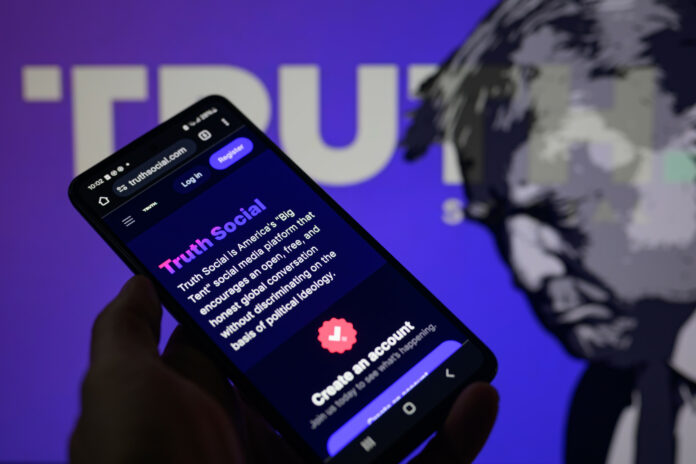

Jonathan Raa/NurPhoto via Getty Images

The stock’s lofty short borrow fee of 790 percent last week meant that bullish short sellers would incur a daily cost of around $1 per share to bet against it when the price hovered at $48.81.

Now, with the stock at $31.43, the reduced borrow fee of 124 percent slashes that expense to just about 10 cents per share each day.

The practice of short selling involves borrowing a stock an investor believes will decrease in value, selling it at the current market price, and then planning to buy it back later at a lower price.

The difference, if any, becomes the investor’s profit.

The drop in the costs associated with short-selling the stock signals a shift in market perceptions of risk regarding Trump Media, even as Donald Trump remains the largest shareholder amidst a series of high-profile legal challenges.

As the company’s value takes a dive, with billions of dollars in market capitalization wiped out, the reduced short selling cost adds to the woes of an already beleaguered stock.

Trump’s 58.1 percent stake in the company, once valued at a high of roughly $5.5 billion, has depreciated to $2.4 billion and continues to slide, a situation exacerbated by a six-month post-merger lockup period prohibiting the sale of his shares.

Newsweek has sought comment from Truth Social through its designated investor relations channel on Tuesday.

The tumult at Trump Media mirrors the volatility surrounding its principal shareholder. Trump, set to face his hush money trial on Monday, faces accusations of concealing payments made to adult film actress Stormy Daniels to prevent damaging information from reaching the public during the 2016 presidential campaign.

That case alone includes 34 counts of falsifying business records, which could carry serious legal penalties.

At the same time, the former President is embroiled in a case involving the alleged illegal retention of classified documents at his Mar-a-Lago estate. Here, Trump is contending with 40 felony counts.

The documents, which are claimed to have been taken from the White House to Mar-a-Lago, are said to contain sensitive national security information, the unauthorized retention of which is a breach of federal law.

The legal challenges could affect Trump’s ability to manage his business affairs, particularly if the trials result in convictions, which former U.S. acting solicitor general Neal Katyal has publicly deemed likely.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.